Have Questions about Financial Assistance? Contact financial aid at FinancialAid@ncwu.edu.

The Office of Financial Aid provides financial assistance or aid to students who, without such assistance would not be able to pursue higher education. The office utilizes continued service and technological advances to provide students every opportunity in pursuing and continuing their education while maintaining behaviors and standards of professional conduct. The costs and aid are often considered two of the most important factors when attending college. Rest assured, NCWU is considered one of the most affordable private universities in North Carolina.

NCWU is committed to providing an exceptional college experience for every student. That’s why we provide millions in financial aid to our students each year. Your financial aid package can cover tuition, housing, food and more.

FAFSA Financial Aid delays got you concerned?

January 30, 2024: The Department of Education has notified colleges and universities that the FAFSA (Free Application for Federal Student Aid), although available to students, will not be available to schools until March 2024.

If you are considering attending NC Wesleyan but are unsure about these FAFSA delays, understand that we are committed to taking care of our students NOW. If you APPLY FOR ADMISSION TODAY, upon acceptance and after submitting your deposit, you can then take advantage of our FAFSA Delay Initiative from our Office of Financial Aid.

This initiative provides accepted and deposited students with a useful tool that will generate an estimated Financial Aid award. All students are encouraged to complete a quick form to assist NCWU in developing an estimated award in advance of the release of the March financial aid information. Submission of all information is voluntary, however, this is one way, NCWU invests in our incoming students while providing an easy transition and a way of securing your educational future.

Don’t wait on FAFSA, choose the University that puts their students first!

Calculate Your Costs

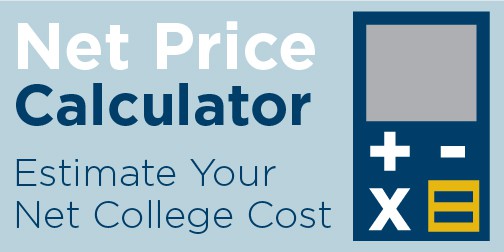

What is Net Price Calculator?

Net price calculators are available on a college’s or university’s website and allow prospective students to enter information about themselves to find out what students like them paid to attend the institution in the previous year, after taking grants and scholarship aid into account. This tool will help you and your family estimate your out-of-pocket costs. It’s easy to use and will take 10 minutes or less to complete.

What does Net Price mean?

Net Price is the amount that a student pays to attend an institution in a single academic year AFTER subtracting scholarships and grants the student receives. Scholarships and grants are forms of financial aid that a student does not have to pay back.

NCWU is Invested in Your Success!

Financial Aid Facts

$25M

is awarded annually in grants and scholarships to NC Wesleyan students.

100%

of Traditional program students are eligible for financial assistance.

#1

Most affordable private, nonprofit university in NC

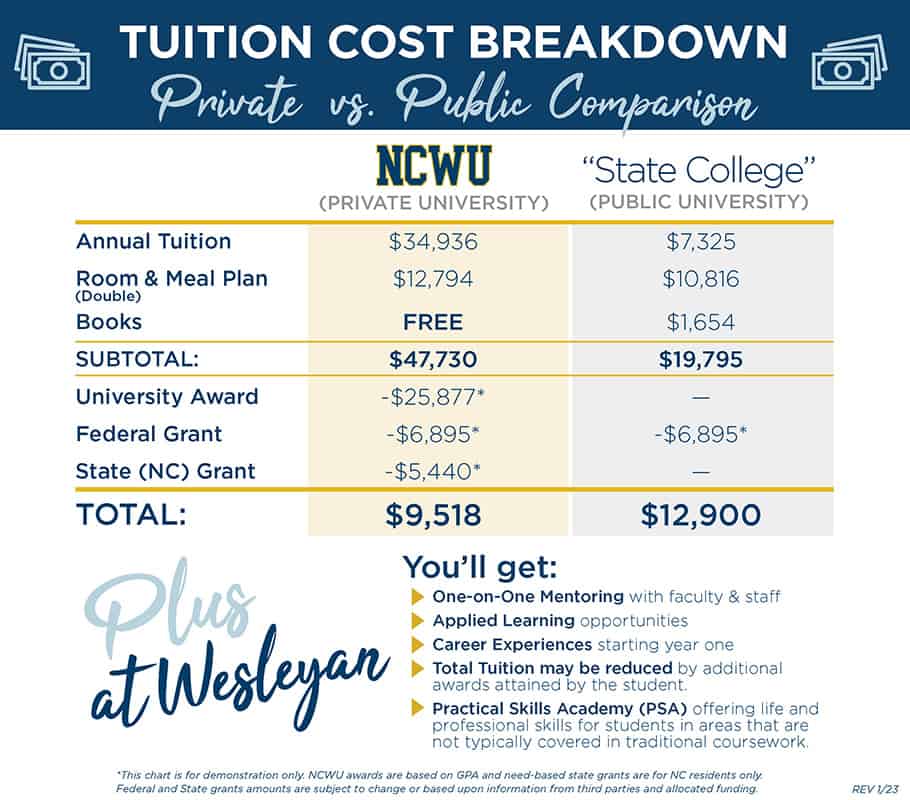

The average scholarship package lowers the cost of attending North Carolina Wesleyan University, which makes Wesleyan comparable in cost with North Carolina’s state universities.

68%

of students attending NCWU receive student loans to assist with their educational expenses.

NCWU 2020 Cohort Default Rate*

0.00%

North Carolina average in 2020: 0.89%

National average in 2020: 0.53%

What are Cohort Default Rates?*

Colleges’ “cohort default rates” (CDRs) measure the share of their federal student loan borrowers who default within a specified period of time after entering repayment. Colleges with high CDRs may lose future eligibility for federal grants and loans.

How is the cohort default rate calculated?

The cohort default rate is a formula where the total number of borrowers who entered repayment in a particular year and defaulted in a two- or three-year term is divided by the total number of borrowers entering repayment in that particular year.

Contact Us

Have questions about tuition or financial aid? The Office of Financial Aid is here to help. Call us Monday to Friday from 8:30 a.m. – noon and 1:00 p.m. – 4:30 p.m. at 252.985.5290 or visit our office in Pearsall Classroom Building, Room 186.

You can also make in-person appointments by emailing FinancialAid@ncwu.edu.