Support the Causes You Care About!

While it’s impossible to know or control what happens in the future, you can have security while achieving your ultimate goals by making a plan. Planning is one way to create a secure future for you and your loved ones. With a good plan, you can rest easy knowing that your family will be well cared for and your property will pass to your intended beneficiaries. Naming Wesleyan as the beneficiary of a retirement plan, financial account, or annuity is another easy way to help further our mission. You can continue to benefit from these assets during your lifetime. A beneficiary designation may also be changed.

Benefits of designating retirement assets to NCWU:

- You can continue to use your account as long as you need to

- Heirs can receive tax-advantaged assets from your estate

- You receive potential tax savings from an estate tax deduction, reducing the burden of taxes on your family

- NCWU will benefit from the full value of your gift (assets will not be taxed upon death)

- Simplify your planning and avoid expensive legal fees

- Receive an estate tax charitable deduction

How to make a gift of retirement assets

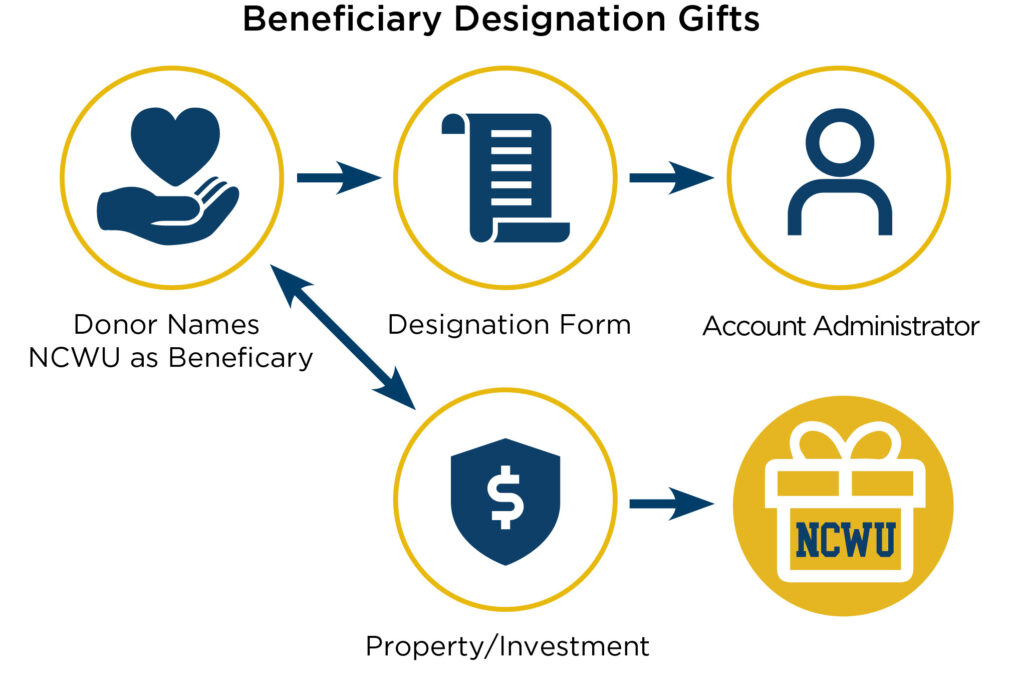

To leave your retirement assets to Wesleyan, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate NC Wesleyan University as beneficiary, we will benefit from the full value of your gift because your retirement assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

By completing a simple form, your asset administrator can designate NCWU as a beneficiary.

Gifts from a Will or Trust

Designating NC Wesleyan as a beneficiary in your will or trust is a simple way to commit to our cause and it does not affect your cash flow during your lifetime. In addition, it’s easy to revoke this type of gift if your situation or goals change.

How do I update my Will designating NCWU as a beneficiary?

Appreciated Securities, Real Property

If you own securities or real estate that you no longer need or wish to sell, a gift of these assets is another way that you can benefit us without impacting your cash flow. You may also benefit from capital gains tax avoidance by giving rather than selling these assets.

Life Estate

If you own your home and wish to remain living there, you can transfer your primary residence, farm, or vacation home to us while retaining the right to use the home during your lifetime. Enjoy the added benefit of an income tax deduction!

To request a FREE North Carolina Wesleyan Planning Guide or receive more information about giving a life income gift to NCWU, contact our Office of Advancement by calling 252.985.5266 or email donorrelations@ncwu.edu.

This information is not intended as tax, legal or financial advice. Gift results may vary. Consult your personal financial advisor for information specific to your situation.